are assisted living expenses tax deductible in 2019

In fact you may be able to deduct a portion of what you pay for assisted living costs. One way to help achieve this is through tax deductions for assisted living.

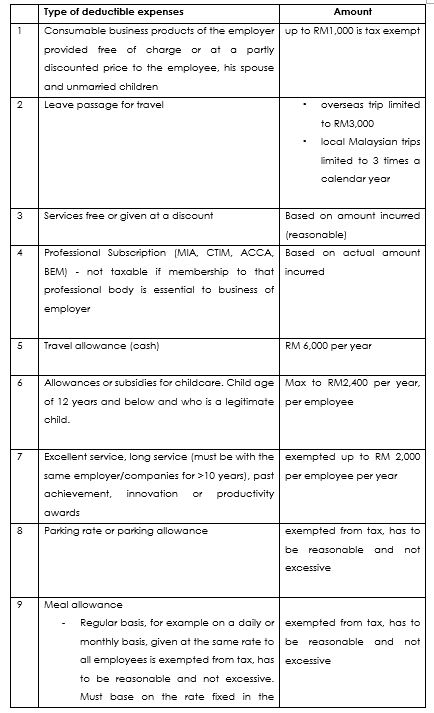

Media Resources Downloads Pembangunan Sumber Manusia Berhad Exemption Of Levy Order 2001 Kwsp 3rd Schedule 7 For Period Apr 2020 To December 2020 Gst Income Tax Forms Gst Forms Epf Kwsp Forms Socso Perkeso Forms News

The Deductibility of Medical Expenses Section 213 of the Internal Revenue Code provides a tax deduction for medical expenses to the extent medical expenses exceed 10 of adjusted gross income.

. Medical expenses including some long-term care expenses are deductible if the expenses are more than 75 percent of your adjusted gross income. Medical care is not a requirement if Robert qualifies as a chronically ill individual and incurs the expense pursuant to a plan prescribed by his doctor or other. Medical costs such as assisted living that is not provided for by insurance or any other source may be deductible.

As long as the resident meets the IRS qualifications see above all assisted living expenses including non-medical costs like housing and meals are tax deductible. By adam September 4 2019. Simply add up the annual cost of assisted living subtract 10 of your gross income and the remaining balance is completely tax deductible.

Deductible Assisted Living Facility Costs. If you your spouse or your dependent is in a nursing home primarily for medical care then the entire nursing home cost including meals and lodging is deductible as a medical expense. Expenses include eligible e xpenses for in-home assisted living or nur sing home services.

Are payments to an Assisted Living Facility Tax Deductible. Tax deductions are available to anyone in assisted living who has been diagnosed as chronically ill. According to the IRS any qualifying medical expenses that make up more than 75 of an individuals adjusted gross income can be deducted from taxes.

In 2020 there is a tax deductible limit for long-term care policies. Lets take a closer. The medical deduction for assisted living includes all the expenses if the primary reason for living in a facility is for medical care.

Chronic Illness and Tax Deductible Status. Some senior living expenses including medical expenses and assisted living expenses are tax-deductible within certain parameters. In order for assisted living expenses to be tax deductible the resident must be considered chronically ill.

A deduction of five percent of an individuals adjusted gross income can be taken. If that individual is in a home primarily for non-medical reasons then only the cost of the actual. What Are the Qualifying Criteria for Assisted Living Tax Deductions.

Which means a doctor or nurse with diagnosing abilities has stated that the patient cant perform at least two daily. However it depends on what that amount includes and why an individual is in catered living. In 2019 this threshold will be 10 percent To qualify for the deduction personal care services must be provided according to a plan of care prescribed by a licensed health care provider.

This is a limit of 10540 for 2019. Whether your loved one is suffering from physical challenges or mental impairment these expenses may be tax deductible. If you or your loved one lives in an assisted living community part or all of your assisted living costs may qualify for the medical expense tax deduction.

And yes even the medical expenses that do not directly affect your health may become deductible depending on certain conditions. Generally a taxpayer can deduct the medical care expenses of his or her parent if the taxpayer provides more than 50 of the parents support costs For some Assisted Living residents the entire monthly. In the event that two persons age 70 and older each own the right kind of long-term care insurance policy and can both deduct as much as 10860 in 2020 the IRS Revenue Procedure 2019-44 allows them to do so.

Assisted living expenses can become extremely expensive in a short amount of time. Yes in certain instances nursing home expenses are deductible medical expenses. He paid the assisted living facility 45000 in 2019.

The Conditions That Determine if Assisted Living Can Become Tax Deductible. In order to be eligible the long-term c are must. You can deduct part or all of your assisted living expenses on your personal tax return if your loved one is living in one of the communities.

In order for assisted living. Depending upon Moms condition and with a bit of planning the assisted living facility costs might be tax deductible. Those whose medical expenses exceed 7 percent of their income qualify for tax relief.

For 2019 the standard deduction is 12200 for a single individual and 24400 f or married. The IRS has laid out the guidelines pertaining to tax deductible medical expenses. If Dad figures adjusted gross income of say 90000 then he can deduct the expenses over 75 of 90000 6750.

Its important to note that each financial situation is unique and personal and that a tax advisor can help you sort through your own taxes to uncover deductions that may apply to you. Yes the payments are deductible under medical expenses. The entire 45000 qualifies as a medical expense and is deductible on Roberts tax return subject to the AGI limitation.

To return to Moms and Dads situation above they have 48600 of medical expenses the assisted living facility costs and the unreimbursed drug expenses. Different medical expenses can be tax deductible. In order for assisted living expenses to be tax deductible the resident must be considered chronically ill This means a doctor or nurse has certified that the resident either.

Medical expenses including some long-term care expenses are deductible if the expenses are more than 75 percent of your adjusted gross income. Medical expenses including some long-term care expenses are deductible if they exceed 10 of your gross income in 2019. Additionally long-term care services and other unreimbursed medical expenses must exceed 75 of the taxpayers adjusted gross income.

If the cost goes over 75 which would be 3375 a year for this example then amounts over this number would be deductible. Medical expenses including some long-term care expenses are deductible if the expenses are more than 75 percent of your adjusted gross income. If you or a loved one is living in an assisted living facility there may be some expenses that qualify as tax deductible.

List Of Tax Deduction For Businesses Cheng Co Group

List Of Tax Deduction For Businesses Cheng Co Group

Truck Driver Expense Spreadsheet Laobing Kaisuo Truck Driver Spreadsheet Drivers

List Of Tax Deduction For Businesses Cheng Co Group

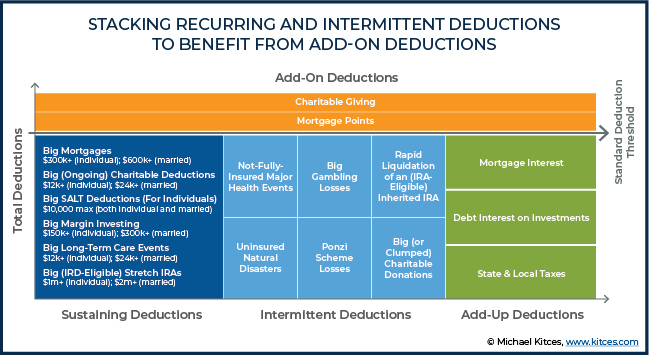

The 6 Types Of Itemized Deductions That Can Be Claimed After Tcja

Tax Deductions For Assisted Living The Arbors Assisted Living Community

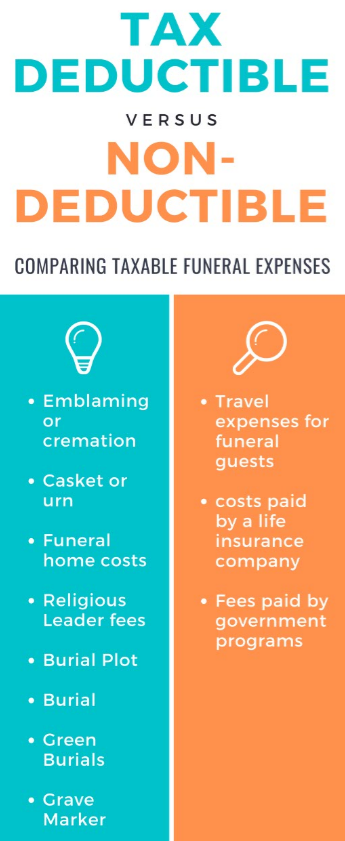

Are Funeral Expenses Tax Deductible Claims Write Offs Etc

10 Tax Deductions For Seniors You Might Not Know About

You May Be Able To Deduct Some Ccrc Costs From Your Taxes Mylifesite

Is Assisted Living Tax Deductible Medicare Life Health

Common Health Medical Tax Deductions For Seniors In 2022

Tax Deductions For Assisted Living

Common Health Medical Tax Deductions For Seniors In 2022

Are Wedding Expenses Tax Deductible Quora

Are Long Term Care Expenses Tax Deductible In Canada Ictsd Org

Private Home Care Services May Be Tax Deductible

Are Funeral Expenses Tax Deductible Claims Write Offs Etc