vermont state tax form

Vermont has a state income tax that ranges between 335 and 875 which is administered. The 1099-G is a tax form for certain government payments.

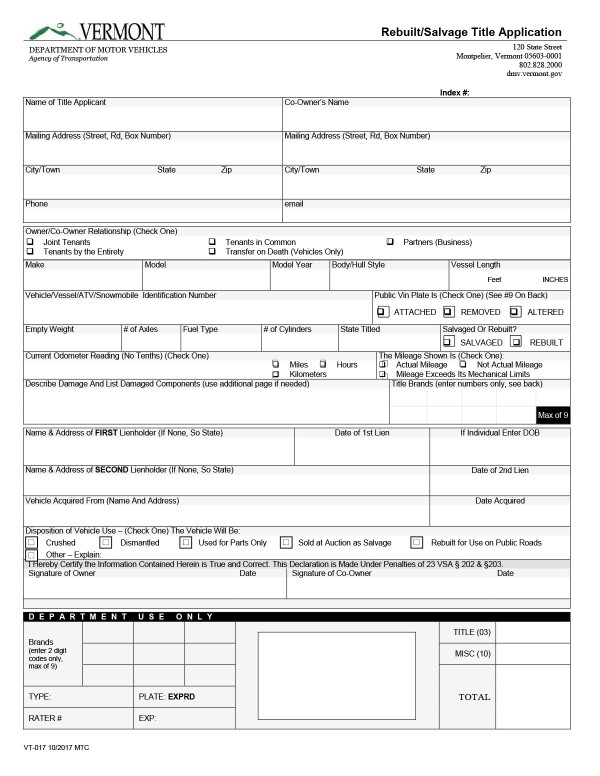

Free Vermont Motor Vehicle Bill Of Sale Form Vt 005 Pdf Eforms

Vermont School District Codes.

. Vermont Printable Income Tax Forms 52 PDFS. Every January the Vermont Department of Labor sends 1099-G forms to individuals who received unemployment. Be sure to verify that the form you are.

Federal Withholding Worksheet Retirement Office Worksheet Form. Retiree Change of Address Form Retiree Change of. Before the official 2022 Vermont income tax rates are released provisional 2022 tax rates are based on Vermonts 2021 income tax brackets.

Vermont state income tax Form IN-111 must be postmarked by April 18 2022 in order to avoid penalties and late fees. Ad Access Tax Forms. Vermont Estate Tax Information And Application For Tax Clearances.

Nonresident alien who becomes a resident alien. Designation of Beneficiary Form Designation of Beneficiary Form. Forms Request Vermont Department of Taxes 133 State Street Montpelier VT 05633-1401.

802 828-2301 Toll Free. Printable Income Tax Forms. A Purchase and Use Tax Computation - Leased Vehicle Form form VD.

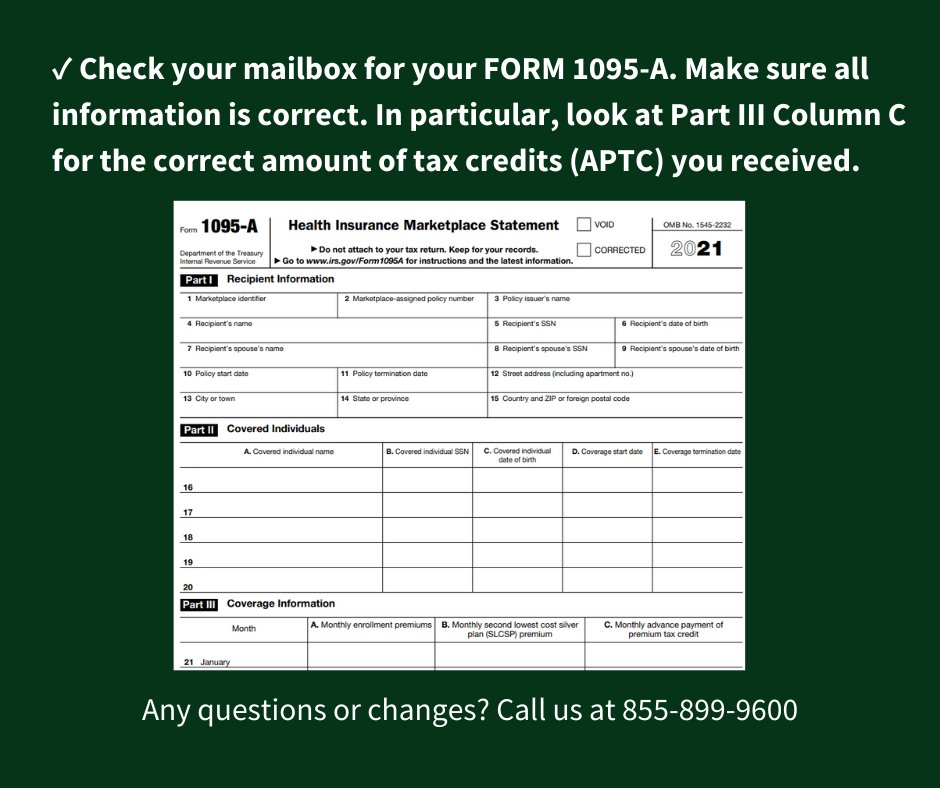

Enter the amount determined from the VT tax tables Can be found in the Tax return booklet Enter 100 for all state taxes paid in VT only. If you file Vermont state taxes you will need to report the months that you had health coverage which you can find on your Form 1095-B. Taxpayers in Vermont file Form IN-111 the long version of the Vermont Individual Income Tax Return for their income tax return.

IN-111 Vermont Income Tax Return. Office of the State Treasurer 109 State Street Montpelier Vermont 05609 Main Phone. Request 1099-G Tax Documents.

The Department has worked to ensure information was correct to the best of its ability. PA-1 Special Power of Attorney. EST-195 2020 Included with.

However if information on-file was provided incorrectly or if claimants. The 2022 state personal income tax brackets. EST-191 2020 Instructions 2019 Estate Tax Return - death occurring after Dec.

PUBLIC INFORMATION REQUESTS TO. Please include your full name company name if applicable mailing address form name or. Printable Vermont state tax forms for the 2021 tax year.

If you are a part-year resident and want to avoid double. Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today. W-4VT Employees Withholding Allowance Certificate.

Same as line 16 Typically none Typically none. The appropriate Form W-8 or Form 8233 see Publication 515 Withholding of Tax on Nonresident Aliens and Foreign Entities. The registration application is received from a Vermont Dealer or a Vermont Dealer acting on behalf of the Lessor.

Ad Download Or Email Form HS-122 More Fillable Forms Register and Subscribe Now. Complete Edit or Print Tax Forms Instantly. You dont need Form 1095-B to file federal taxes.

Tax Year 2021 Personal Income Tax Forms Department Of Taxes

Maine Tax Forms And Instructions For 2021 Form 1040me

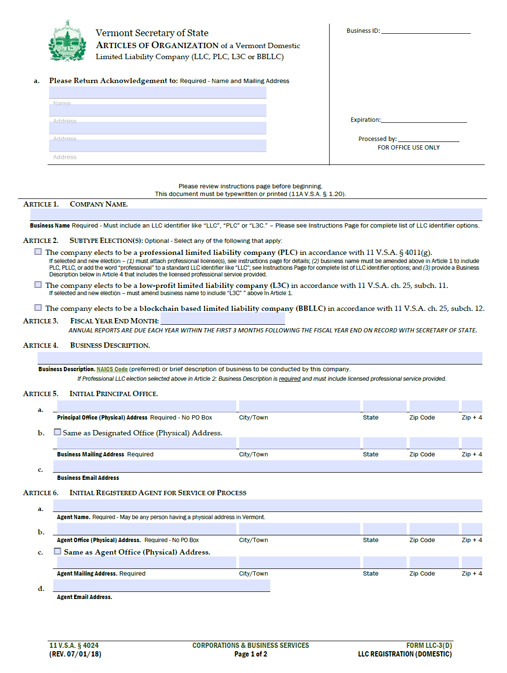

Vermont Llc How To Start An Llc In Vermont Truic

State W 4 Form Detailed Withholding Forms By State Chart

Fillable Online State Vt Vermont Use Tax Return State Of Vermont State Vt Fax Email Print Pdffiller

Free Vermont Bill Of Sale Forms Pdf

Tax Year 2021 Personal Income Tax Forms Department Of Taxes

About Bills Of Sale In Vermont Key Forms Information

California Tax Forms 2021 Printable State Ca 540 Form And Ca 540 Instructions

Complete And E File Your 2021 2022 Vermont State Tax Return

Follow Vt Health Connect S Vthealthconnect Latest Tweets Twitter

California Tax Forms H R Block

Oklahoma Tax Forms 2021 Printable State Ok 511 Form And Ok 511 Instructions